What’s a 990-N?

Since 2010, the IRS has required all nonprofit tax exempt organizations to file an annual information return. All means all nonprofit tax exempt organizations, except churches. The IRS Form 990-N is a simple, online form that all nonprofit tax exempt organizations with annual gross revenues of less than $50,000 must file every year. That means your homeschool group (unless you are under the ministry of a church) has an annual filing requirement with the IRS to maintain your tax exempt status.

When is the 990-N due?

The Form 990-N is due 4 1/2 months after the end of your fiscal year, so for groups that run on a calendar year the due date is May 15. For groups with a June 30 year聽 end, the due date is November 15.

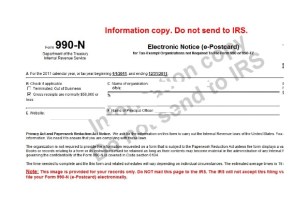

What聽 does the Form 990-N ask?

The Form 990-N is very simple. It is only 6 questions. No financial information is given.

A. Calendar year or tax year dates

B. Check if gross receipts are $50,000 or less

C. Name and address of organization

D. Employer Identification Number (EIN)

E. Website

F. Officer name and address

How do I file the Form 990-N?

It is filed online at the IRS.gov website IRS.gov/990N

We’re not a 501(c)(3) yet. We’re going to apply, but haven’t yet. Do we still need to file the Form 990-N?

Yes, you do. Start filing the Form 990-N even before you file for 501(c)(3) tax exempt status or while your application with he IRS is pending.

We self-declared 501 tax exempt status. Do we still need to file the 990-N?

Nonprofit organizations can self declare 501c3 tax exempt status if their annual gross revenues are under $5,000 per year or as a聽501(c)(7) Social club聽 with any amount of revenue. File a 990-N even if you are a self declared 501(c)(3) educational organization or a 501(c)&) social club. Read more about how to self-declare tax exempt status.

Since you have not applied for 501(c)(3) status, you are not in the IRS database, so you need to call the IRS Customer Account Services at 1-877-829-5500 and be added to their database so you can begin filing the Form 990-Ns. It typically takes 6 weeks after you call to be added to the IRS database.

What happens if I file the 990-N late?

The IRS will send you a reminder notice if you do not file your 990-N on time, but the IRS does not assess a penalty for late filing.

What happens if I fail to file the Form 990-N for three consecutive years?

If you fail to file for three consecutive tax years, you will lose your tax exempt status. This will聽 occur on the filing due date of the third year.聽 If you lose your tax exempt status, you must reapply for tax exempt status. This means filing the Form 1023, the new shorter 1023-EZ or 1024. (I can help with that. Contact me) and paying the IRS filing fees.聽 You may owe taxes for the period when you were not tax exempt.

The IRS requires that all organizations who lose their tax exempt status file the Form 1023/1023-EZ/1024 even if they were exempt from filing the form before.

That means doing the paperwork and paying the IRS filing fee ($275 or $600).

We’ve never filed any forms with the IRS. Why now?

Before 2006, small nonprofits with annual gross receipts under $25,000 did not have to make any yearly filings with the IRS. But in 2006, Congress and the IRS introduced a new form, the 990-N. The IRS needed to clean out their database of nonprofit organizations, many who had old addresses or were closed. The Form 990-N keeps the IRS and donors up-to-date on tax exempt status of small organizations.

Will we owe back taxes or penalties?

There may be a period of time when your organization was not tax exempt. The IRS may expect you to pay income tax for that period, but you can get your 501c3 tax exempt status retroactively reinstated to the date it was revoked and availd paying taxes. You should do this by filing the IRS Form 1023-EZ. This webinar will explain how to file the Form 1023-EZ: 501c3 Application for Homeschool Nonprofits .

I have never heard of this before and now I think we’re in trouble! What should I do?

1. Stay calm. Everything will be OK.

2. Read my blog posts on Form 990-N.

3. Discuss the situation with your board. Determine if you are eligible or retroactive reinstatement of 501c tax exempt status. IRS has streamlined procedure to get tax exempt status reinstated.

4. Consider arranging a phone call with me, Carol Topp, CPA to discuss the next step and your options. Contact me

I hope that helps!

Carol Topp, CPA

I know a small, poor charity that is about to go out of business because the e-postcard is so difficult to file. Worse yet it has to be attatched to a state filing. It has become nearly impossible to find a computer (members mostly do not have home computers & the small town public computer is usually broke down) and even if someone has a printer they usually do not have a printer. Last year the group did the postcard online & filed the state form online in order to avoid printing the postcard. Despite a confirmation the state says they never received anything & the group is going to be destroyed with fines for late filing.

People doing charitable work in a poor area are faced with buying expensive equipment or hiring a cpa to file one electronic document/year. In my opinion there should be an option to file on paper, via USPS. It is unreasonable to more or less force ordinary people trying to help others, to buy hundreds of dollars worth of equipment plus pay monthly service charges, in order to continue charitable work. The group is happy to report income, assets and expenditures, and comply with rules and regulations but it is becoming impossible and the board is discussing disbanding because of the e-postcard. That would be tragic in my opinion and there needs to be a better way.