Despite being exempt from federal taxes, companies must file annual declarations. Otherwise, the organization would be breaching one of the requirements imposed by the IRS (Internal Revenue Service). To present these declarations, you will need to file Form 990.

It seems like a tedious and unnecessary requirement; however, it helps the State to ensure that non-profit organizations are using their funds appropriately and responsibly, and not for other purposes than those described by law.

If you are interested in knowing about this form, its importance, classifications, and how to file it, we prepared a guide that will surely be very helpful.

What is Form 990, and why is it important?

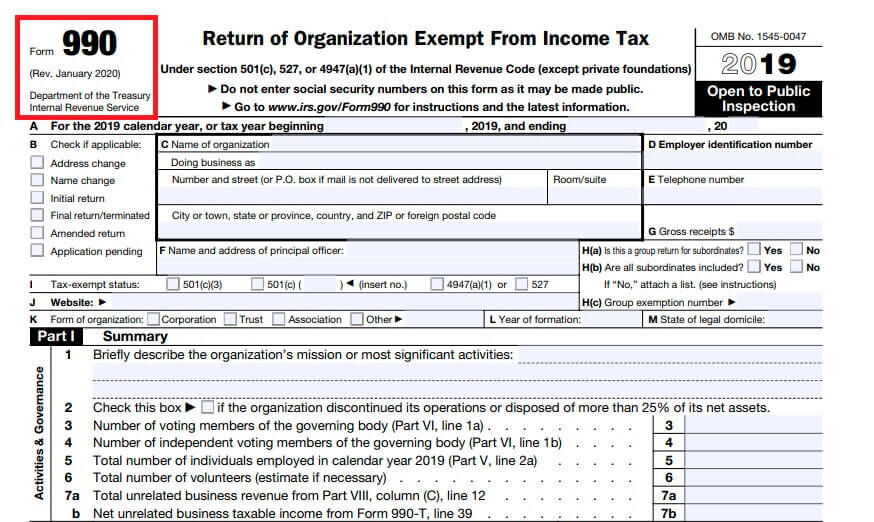

It is a declaration that must be made by organizations exempt from income tax; it shows the financial information of a non-profit to ensure the proper use of this benefit.

If a donor wants to give a certain amount of money to an organization, he will likely request Form 990, since it shows relevant information to decide if he shares the same values and purposes.

In this document, you will find highly detailed financial information, such as the mission of the non-profit organization, events, structure, names of the directors, employees, and their salaries, as well as the income, expenses, assets, and liabilities of the organization.

This declaration is annually, and there is a penalty fee of $ 20 for each day that the organization does not file it. And anyone who intentionally does not complete this form will be added another penalty fee of $ 5,000.

As a result, here is a curious fact: In 1998, the IRS collected more than $ 10 million in penalties on more than 9,000 organizations.

To download the complete Form 990, click here.

➡ READ ALSO: Role of board of directors in non-profit organizations

Types of Forms: 990n vs. 990ez

The instructions may vary depending on the type of non-profit organization and the amount of its financial assets and liabilities. These forms are designed to specific entities, so it is very important to use the appropriate one:

- Form 990ez: It is a brief statement of income tax. It is used by tax-exempt organizations with a gross income of less than $ 200,000 and assets valued under $ 500,000. This version is shorter, and it helps organizations make fewer mistakes.

- Form 990n: It is designed for non-profits with a gross income of less than $ 50,000. There is not a specific paper-form; it is an electronic notification called e-Postcard that you complete online after you sign up in the IRS official website. Click here to find more information about it.

Non-profit organizations with a gross income that exceeds $ 200,000 and assets valued in more than $ 500,000 must complete the Form 990.

Form 990 filing requirements

The complete form is extensive and has several parts; it is a compendium of 12 sections in total that we will briefly explain below.

Parts I-IV

- The first part describes a summary of the organization’s basic information, for example: the number of employees and volunteers, income, expenses, and assets.

- Part II is the expression of the will of the directors to ensure that the information is legitimate and complete.

- Part III explains the objectives achieved by the organization, including its statement of expenses and income for the organization’s most significant programs.

- Part IV contains a checklist of required schedules to complete.

- Part V contains information about other IRS declarations and tax compliances.

- Part VI is the one that requests information about the highest administrative body of the organization and its bylaws.

Parts VII-XII

- Part VII must list in detail the compensation to your current and former employees and directors, trustees, and those who receive more than $ 100,000.

- Part VIII is the statement of revenues from exempt funds income and unrelated businesses.

- Part IX must report the expenses of the entire organization.

- Part X must contain the balance of the organization.

- Part XI is a conciliation of the organization’s net assets.

- And finally, Part XII explains in detail the organization’s financial statements and reports reviewed by an independent accountant.

If you need help when filling this form, you can access here to the instructions.

In conclusion, the Form 990 is a requisite that may define the organization’s continuity. So, to be sure to do it right, we recommend you to get assistance from an attorney or accountant familiar with tax legislation.