5/20/2019 全球金融市场总结 Market Wrap

作者: 灰岩金融科技

| 发布于: | 雪球 | 转发:0 | 回复:0 | 喜欢:1 |

5/20/2019 全球金融市场总结 Market Wrap

原创: Dorian君 灰岩金融科技 今天

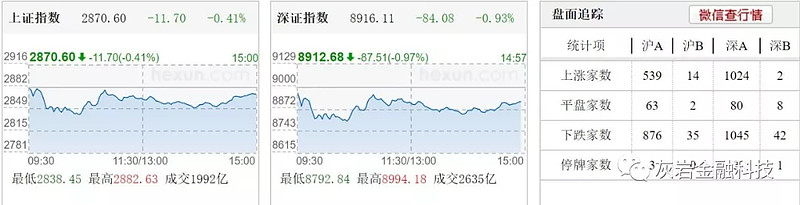

A股市场

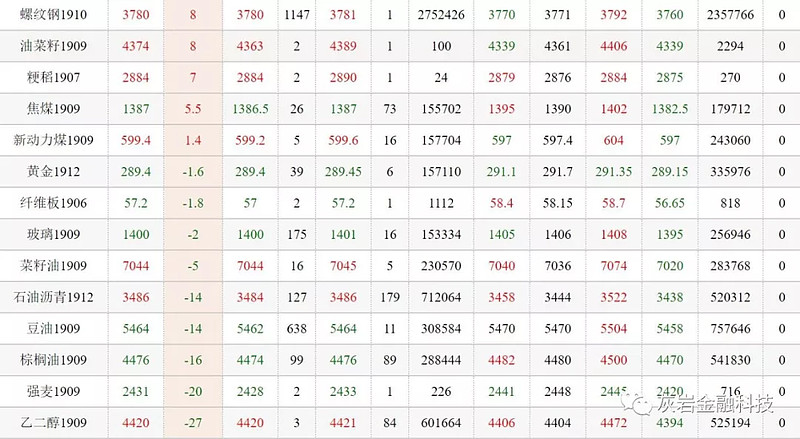

期货市场

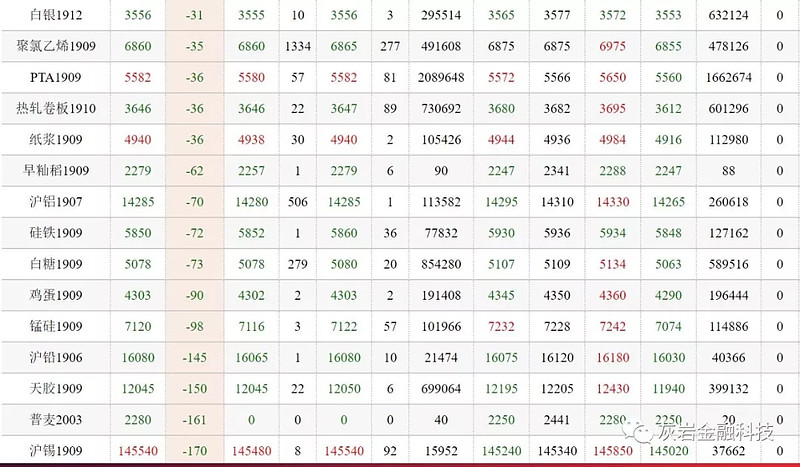

美股市场热力图

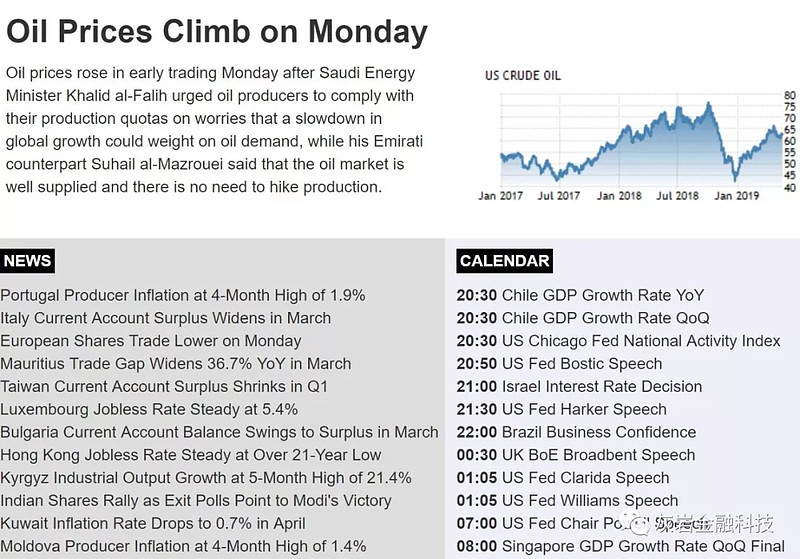

国际金融市场概况

国际外汇市场

国际大宗商品期货市场

国际债券市场

Opening Wrap – Monday May 20, 2019

开盘总结- 2019年5月20日周一

In Asian Equity Markets indices were mostly higher on Monday amid rising tensions between the U.S. and China. The Nikkei 225 in Japan added 0.51% in morning trade, as shares of index heavyweights such as Fast Retailing and Softbank Group advanced. In South Korea, the Kospi added 0.71%. The ASX 200 in Australia rose 1.23%, with the country’s incumbent government headed for a surprise win at the polls, and is widely expected to hold on to power. The financial sub-index jumped more than 4.5%. Hong Kong’s Hang Seng index was largely flat.

在亚洲股票市场,由于美中关系日益紧张,周一指数大多走高。 由于Fast Retailing和Softbank Group等指数权重股的股票上涨,日本 日经225指数上涨0.51%。 在韩国,Kospi上涨0.71%。 澳大利亚澳大利亚证券交易所200指数上涨1.23%,该国现任政府在民意调查中意外获胜,人们普遍预计其将继续执政。 金融分类指数跃升超过4.5%。 香港恒生指数基本持平。

In Currency Markets the Australian dollar got a boost against the greenback on Monday following a surprise election victory by the country’s conservative government, while the yen dipped slightly on a recovery in market sentiment. The Aussie was the big mover early in Asia and was last up half a percent at $0.6904, having bounced from a four-month trough of $0.6865. It was briefly quoted as high as $0.6990 but dealers said that was a miss-hit and the true dealt peak was $0.6938. The dollar index against a basket of six currencies was largely steady at 97.970.

在货币市场方面,周一澳元在美国保守党政府大选取得意外后获得美元升值,而日元因市场情绪复苏而小幅下挫。 澳元是亚洲早期的重要推动因素,上涨0.5%至0.6904美元,从四个月的低点0.6865反弹。 它的报价高达0.6990美元,但交易商表示这是一个未命中的,真正的交易高峰是0.6938美元。 一篮子六种货币的美元指数基本稳定在97.970。

In Commodities Markets oil rose to multi-week highs on Monday after OPEC indicated it will likely maintain production cuts that have helped support prices this year, while tensions continued to escalate in the Middle East. Brent crude was up by 96 cents, or 1.3%, at $73.17 a barrel, having earlier touched $73.40, the highest since April 26. U.S. WTI crude was 82 cents, 1.3%, higher at $63.58 a barrel. The U.S. benchmark reached $63.81 earlier, the highest since May 1. The rig count, an early indicator of future output, fell by 3 to 802, GE’s Baker Hughes energy services unit said on Friday.

大宗商品市场周一石油价格上涨至多周高点,此前石油输出国组织表示可能会继续减产,这有助于今年支撑价格,而中东的紧张局势继续升级。 布伦特原油上涨96美分,或1.3%,至每桶73.17美元,此前触及73.40美元,为4月26日以来的最高点。美国WTI原油价格为82美分,上涨1.3%,至每桶63.58美元。 GE的贝克休斯能源服务部门周五表示,美国基准价早前达到63.81美元,为自5月1日以来的最高水平。钻井数量是未来产量的早期指标,下降3至802。

In US Equity Markets stocks struggled for direction after three days of gains on Friday, as investors weighed mixed headlines on trade, with China’s aggressive stance in its trade war with the United States remaining an overhang. After opening down 0.75%, the S&P 500 erased some losses after media reports that the United States was close to a deal to remove tariffs on steel and aluminum imports from Canada and Mexico. The S&P 500 was up 1.99 points, or 0.07%, at 2,878.31 and the Nasdaq Composite was down 15.06 points, or 0.19%, at 7,882.99.

美国股票市场股市在周五三天上涨后挣扎,因为投资者对交易的头条新闻不一, 在开盘下跌0.75%之后, 标准普尔500指数在媒体报道称美国接近取消从加拿大和墨西哥进口钢铁和铝协议后,抹去了一些损失。 标准普尔500指数上涨1.99点,或0.07%,收于2,878.31点, 纳斯达克综合指数下跌15.06点,或0.19%,收于7,882.99点。

In Bond Markets trade tension between the United States and China ratcheted up again on Friday, pushing Treasury yields lower as traders sought safety in high-quality assets. Yields across maturities were lower, with the biggest moves at the long end of the yield curve. The 10-year yield was last down 1.1 basis points to 2.394%, with the 30-year yield last down 1.5 basis points at 2.825%.

在债券市场,国债收益率走低,因交易商寻求高质量资产的安全性。 期限内的收益率较低,收益率曲线的长期收益率最大。 10年期国债收益率下跌1.1个基点至2.394%,30年期收益率下跌1.5个基点至2.825%。

MARKET ANALYSIS - 5/17/2019

2019年5月17日市场分析

This coincided with a news that auto sales in China and Europe had fallen again, down 2.9% YoY since January 1st with a 24% YoY plunge in China in the first week of May. China remained centre stage with industrial production, exports, PMI and new lending all missing expectations. Meanwhile, Donald Trump issued a thinly-veiled anti-Huawei decree forbidding US companies to use telecom equipment produced by companies that might pose a national security risk.

与此同时,有消息称中国和欧洲的汽车销量再次下滑,自1月1日以来同比下降2.9%,中国在5月的第一周同比下滑24%。 中国仍然处于工业生产,出口,采购经理人指数和新增贷款的中心位置。

In the UK, T. May said she would resign at the end of June but would nevertheless put her draft Brexit agreement once again to a Commons vote at the beginning of the month. B. Johnson returned to the spotlight by bidding for the position of Conservative party leader. And in Italy, Matteo Salvini eventually opted for a deficit with EU rules (130-140% of GDP), abandoning his tough approach. US-Iran tensions rose a notch after the US embassy in Iraq recalled its staff.

在英国梅姨表示她将在6月底辞职,但仍会在本月初再次将她的英国脱欧协议草案交给Commons投票。 B.约翰逊通过竞标保守党领袖的位置而重新成为焦点。 而在意大利,Matteo Salvini最终选择了欧盟规则的赤字(占GDP的130-140%),放弃了他的强硬态度。 在美国驻伊拉克大使馆召回员工后,美伊紧张局势有所上升。

Against this eventful backdrop, equity markets had a chaotic run, switching between up and down days but Europe ended up higher over the week while the US and Japan were flat. Systematic investors underpinned the market while discretionary investors stayed cautious. Chinese equities fell by more than 2% in Hong Kong and Shenzhen. Currency markets also saw big swings with the renminbi taking 10-day losses to more than 2% on higher customs tariffs. That said, a cheaper renminbi is in China's interest. The ongoing split between equities and bonds continued with equity markets failing to go for defensives while bonds sought out quality, taking yields down a few basis points.

在这种多事的背景下,股市出现了混乱,在上下两天之间转换,但欧洲在本周收高,而美国和日本持平。 系统性投资者支撑市场,而自由投资者保持谨慎态度。 A股在香港和深圳下跌超过2%。 货币市场也出现大幅波动, 股票和债券之间的持续分离继续,股票市场未能采取防御措施,债券寻求质量,收益率下降几个基点。

Our asset allocation is unchanged. We remain cautious on equities and are maintaining low interest rate exposure. Looking beyond technical factors, we feel that equity markets currently carry asymmetrical downside risk. Earnings have not been disappointing but, in today's top-of-the-cycle situation with neutral valuations, high margins and strong YTD market gains, they have not been positive enough to justify a new upswing.

我们的资产配置没有变化。 我们对股市保持谨慎,并维持低利率风险。 除技术因素外,我们认为股票市场目前存在不对称的下行风险。 盈利并未令人失望,但在今天的顶级形势中,估值中性,利润率高以及年初至今的市场增长强劲,他们的积极性不足以证明新的上涨。

European Equities

欧洲权益市场

Confusion reigned on markets due to sometimes contradictory news as the trade war continued. Sentiment initially took a knock when China riposted to Washington’s new tariffs but improved on hopes that a favourable solution might be found at the upcoming G20. Macro data was also mixed. China’s industrial production fell but US housing starts and the “Philly Fed” ended up being more reassuring and France’s unemployment rate dropped to a 10-year low. Autos followed a similar trend, first falling because of possible US import tariffs and then rallying on news that any measure would be postponed for 6 months. Renault, however, tumbled after Nissan issued a profit warning and on mounting concerns over the group's governance.

近期市场出现相互矛盾的消息,导致市场情绪混乱。 宏观数据也好坏参半。 国内PMI下降,但美国房屋开工和“费城美联储”最终更令人放心,法国的失业率降至10年来的最低点。 汽车也出现了类似的趋势,然后因任何措施推迟6个月的消息而上涨。 然而,在日产发布盈利预警以及对该集团治理的担忧日益加剧之后,雷诺大跌。

First quarter earnings reports continued and were generally upbeat. Markets cheered pleasant surprises like Salvatore Ferragamo’s results. Allianz also released solid figures as strong non-life business offset weakness in its asset management arm. STM reiterated its 2019 objectives and medium-term targets are for an encouraging €12bn in revenues with a 17-19% margin. Vodafone, however, confirmed that the telecoms sector was in difficulty and cut its dividend to spend more on bidding at 5G auctions in Germany and Italy. Bouygues bucked the trend after halting the Average Revenue Per User (ARPU) erosion and reporting upbeat sales.

第一季度收益报告仍在继续,并且普遍乐观。 市场为Salvatore Ferragamo的结果带来了惊喜。 由于强大的非寿险业务抵消了其资产管理部门的疲软,安联也公布了可靠数据。 STM重申其2019年的目标,中期目标是获得120亿欧元的令人鼓舞的收入,利润率为17-19%。 然而, 沃达丰证实,电信行业陷入困境,削减股息,在德国和意大利的5G拍卖会上投入更多资金。 在停止每用户平均收入(ARPU)侵蚀并报告乐观销售后, Bouygues逆势而上。

In company transformation news, there was speculation that Finland’s Kone might want to bid for ThyssenKrupp’s lift division even though it is gearing up for an IPO. ThyssenKrupp nevertheless saw selling after making cautious forecasts and focusing on cutting debt rather than returning cash to shareholders. Volkswagen confirmed the IPO of its truck division before the summer as part of a broader disposal programme of non-core assets. Norway’s finance ministry gave Euronext the green light to buy Oslo Bors. Arkema is paying $570m for US chemicals group Arrmaz. UniCredit is being advised on a possible bid for Commerzbank. Vinci finalised its acquisition of most of Gatwick airport.

在公司转型新闻中,有人猜测芬兰的Kone可能会想要竞购蒂森克虏伯的升降机部门,尽管它正准备进行首次公开募股。 然而,蒂森克虏伯在做出谨慎预测并专注于削减债务而不是向股东返还现金之后看到了抛售。 作为更广泛的非核心资产处置计划的一部分, 大众汽车在夏季之前确认了其卡车部门的首次公开募股。 挪威财政部向泛欧交易所提供了购买Oslo Bors的绿灯。 阿科玛为美国化学品集团Arrmaz支付了5.7亿美元。 UniCredit正在就可能对德国商业银行的收购提出建议。 达芬奇最终收购了盖特威克机场的大部分地区。

US Equities

美国权益市场

US markets initially fell on Chinese ripostes to US measures before rebounding on news that tariffs on European imports had been postponed. The S&P500 edged 0.2% higher and the Nasdaq was virtually unchanged. US 10-year Treasury yields fell by 8bp on mounting expectations that risks to global growth from the US-China trade dispute would lead the Fed to cut. There was a perceptible rotation into defensives. Financials fell 1%, quite logically given lower bond yields, while industrials shed 0.5% and semiconductors tumbled 3% on US-China tensions. Utilities (+2.4%) and consumer staples (+2.3%) led gains. Cisco jumped 6% after beating expectations. The group's security division saw profits rise 20% and management was confident they could adjust production chains in China despite import tariff risks. Electronic Arts and TakeTwo both advanced 5% on news of the Microsoft-SONY partnership in cloud gaming. TakeTwo was also lifted by reassuring quarterly figures and positive reactions to its video game, “Red Dead Redemption”.

由于欧洲进口关税被推迟的消息反弹, 标准普尔500指数小幅上涨0.2%, 纳斯达克指数几乎没有变化。美国10年期国债收益率下跌8个基点,因市场预期美联储将缩表以对冲宏观风险。防御者有一种可察觉的轮换。由于债券收益率下降,金融股价格下跌1%,而工业股票下跌0.5%,半导体因美中紧张局势下跌3%。公用事业(+ 2.4%)和消费必需品(+ 2.3%)领涨。在击败预期后, 思科股价上涨6%。该集团的安全部门的利润增长了20%,管理层相信他们可以调整中国的生产链。凭借 微软与SONY在云游戏领域的合作关系,Electronic Arts和TakeTwo均上涨了5%。 TakeTwo也因为令人放心的季度数据和对其视频游戏“Red Dead Redemption”的积极反应而被解除。

Japanese Equities

日本权益市场

Japanese equities remained weak on worries over the US-China trade dispute and the impact of any further escalation on Japan’s economy. The TOPIX lost 0.77% this week.

由于对美中贸易争端的担忧以及任何进一步升级对日本经济的影响,日本股市依然疲弱。 TOPIX本周下跌0.77%。

Following the disappointing Economic Composite Index for March from Japan’s Cabinet Office, the fundamental view on the economy was downgraded to ‘deteriorating’. This put pressure on the Abe administration to change the government’s official take on the situation and consider postponing the consumption tax hike. The government has so far maintained the rise, which comes with some stimulus measure, and plans to continue so long as there is no serious event like the 2008 global financial crisis.

继日本内阁办公室3月令人失望的经济 综合指数后,对经济的基本看法被降级为“恶化”。 这给安倍政府施加了压力,要求改变政府对局势的正式看法,并考虑推迟消费税上调。 到目前为止,政府一直保持着这一上涨趋势,并伴随着一些刺激措施,并且只要没有像2008年全球金融危机那样的严重事件,政府就会继续这样做。

The Nikkei reported a fall of approximately 2% in aggregate net earnings for 849 listed companies for the financial year ending March 2019. Second half earnings fell more quickly due to non-domestic factors. However, though uncertainty remains, earnings for the 2019 financial year are expected to return to positive territory.

日经指数显示截至2019年3月的财政年度,849家上市公司的总净收益下降约2%。由于非国内因素,下半年盈利下滑更快。 然而,尽管存在不确定性,2019财年的盈利预计将回归正面。

Emerging Markets

新兴市场

The US-China trade war continued to dominate the headlines with signs of escalation this week. In retaliation to the increase in tariffs in the previous week on Chinese imports, China now plans to raise tariffs on $60b of US goods from June 1st. There was also a change in terminology from the state media, shifting from “trade tension” to “trade war”. The US also announced further measures, by banning domestic telecom companies from using Huawei equipment. Meanwhile, economic data in China pointed to a broad-based slowdown in April. The auto market remained under pressure, with CAAM reporting wholesale shipments down 14.6% YoY. Real estate was the only bright spot, with April sales value up by 13.9% YoY, an acceleration in growth compared to the past 2 months.

本周出现升级迹象。经济数据显示4月份基本面放缓。 汽车市场仍然面临压力,CAAM报告批发出货量同比下降14.6%。 房地产是唯一的亮点,4月份销售额同比增长13.9%,与过去2个月相比增长加速。

Tencent, Alibaba and Baidu reported their quarterly numbers. Tencent announced mixed results, with weakness in advertising offset by gaming and fintech. Alibaba revenues and profit were above consensus expectations, driven by strong core commerce business with 54% revenue growth. The company also forecast 33% organic sales growth for fiscal 2020. Baidu, on the other hand, disappointed, with slowing ad revenue growth (+3% vs. +10% last quarter) and lower margins.

腾讯, 阿里巴巴和百度报告了其季度数据。 腾讯公布业绩喜忧参半,广告业务因游戏和 金融科技而受到影响。 由于核心商业业务强劲,收入增长54%,阿里巴巴的收入和利润均高于市场预期。 该公司还预测2020财年有机销售增长33%。另一方面,百度令人失望,广告收入增长放缓(上季度+ 3%+ 10%)和利润率下降。

In India, market was waiting for the results of next week’s Lok Sabha election. ITC reported solid numbers, with 8% cigarette volume growth and an EBIT margin expansion for the FMCG business to the highest level ever. LG Chem (Korea) and CATL (China) both signed a long-term contract with Volvo to supply batteries for their electric vehicles.

在印度,市场正在等待下周Lok Sabha选举的结果。 ITC报告的数据稳健,卷烟销量增长8%,快速消费品业务的息税前利润率扩大至有史以来的最高水平。 LG化学(韩国)和CATL(中国)都与沃尔沃签订了长期合同,为其电动汽车提供电池。

Brazil was down for the week, with concerns from investors about the government’s ability to get pension reform through. PagSeguroannounced upbeat results, driven by a higher-than-expected 45% increase in revenues and operational leverage. Cosan reported good numbers as well, driven by solid performance on Comgas.

巴西本周下跌,投资者担心政府有能力通过养老金改革。 由于收入和运营杠杆增长45%,高于预期,PagSeguro宣布了乐观的结果。 由于Comgas的稳健表现, Cosan报道了良好的数据。

In South Africa, the final results of the election put the ruling African National Congress (ANC) at 57.5%, or 5% less than in the previous elections. While the number of seats in parliament for the ANC will fall by 19 to 230 out of 400, it should still alleviate concerns about sufficient parliamentary support to execute Cyril Ramaphosa’s reform agenda.

在南非,选举的最终结果使执政的非洲人国民大会(ANC)达到57.5%,比之前的选举减少了5%。 虽然非洲人国民大会议席的席位数将从400个减少到230个,但仍应减轻对议会对执行西里尔·拉马福萨的改革议程的充分支持的担忧。

We remain upbeat on emerging markets.

我们对新兴市场保持乐观。

Commodities

大宗商品市场

Oil prices gained more than $2, taking Brent crude above $73. US-China trade tensions remained acute after an escalation in tariff threats, but the fact that both sides were still talking reassured markets and helped oil to rise. Attacks on Saudi interests made the oil headlines. Two tankers in the Persian Gulf were hit. This was followed by an attack on two pumping stations which led to the temporary shutdown of the gulf’s biggest pipeline. Production was untouched but the events showcased rising regional tensions with Saudi Arabia openly accusing Iran.

油价上涨超过2美元,布伦特原油价格超过73美元。 对沙特利益的攻击使得石油成为头条新闻。 波斯湾的两艘油轮遭到袭击。 随后对两个泵站进行了攻击,导致该海湾最大的管道暂时关闭。 生产没有受到影响,但这些事件表明了沙特阿拉伯公开指责伊朗的地区紧张局势升级。

Teheran, meanwhile, said it would only remain in the nuclear agreement if it could increase exports by 1.5 million b/d. US sanctions make this unlikely. The IEA’s monthly report cut its demand growth outlook by 92,000 b/d to 1.3 million b/d for this year. The drop concerns OECD countries for two-thirds, and especially Asia. A large part, 400,000 b/d, concerns the first quarter as the situation is seen improving subsequently. OPEC and EIA forecasts were unchanged at +1.2m and +1.4m respectively. Non-OPEC production growth was revised up by 131,000 by the AIE and the IEA, mainly because of increased US output. OECD inventories fell in March to flirt with their 5-year mean and are expected to decline in the second half. No decisions were expected at the weekend OPEC meeting but there might be indications on any extension to production cuts.

与此同时,德黑兰表示如果能够将出口量增加150万桶/日,它将只会留在核协议中。 美国的制裁使这种情况不大 国际能源署的月度报告显示,今年的需求增长前景预计将减少92,000桶/日至130万桶/日。 这一下降涉及经合组织国家三分之二,特别是亚洲。 由于随后情况有所好转,第一季度大部分为40万桶/日。 欧佩克和EIA预测分别维持在+ 120万和+ 140万。 AIE和IEA将非欧佩克产量增长率上调131,000,主要是因为美国产量增加。 经合组织库存在3月份下降,与5年均值调整,预计下半年将下降。 周末欧佩克会议没有做出任何决定,但可能有迹象显示任何延长减产的时间。

Industrial production in China, which only rose by 5.4% over a year in April (down from +8.5% in March), is a typical sign of the current slowdown. As a direct result, metal prices fell. Copper is so far down 6% this month and traded close to $6,000 a tonne over the week before rebounding to $6,100. Future metal prices will be dictated by decisions on whether or not taxes on autos are introduced.

工业生产在4月仅增长5.4%(低于3月的+ 8.5%),是目前经济放缓的典型迹象。 直接导致金属价格下跌。 铜价本月下跌6%,本周交易价格接近每吨6,000美元,之后反弹至6,100美元。 未来的金属价格将取决于是否引入汽车税。

Corporate Debt

企业债务市场

CREDIT

信用产品

US-China trade tensions initially weighed on sentiment but the market rallied on more reassuring comments from Donald Trump. Uncertainty over Italy’s budget deficit also prompted concerns. The Xover eventually tightened by around 6bp between Monday and Thursday and the Main by 2bp.

意大利预算赤字的不确定性也引发了担忧。 Xover在周一和周四之间最终收紧了约6个基点,而主要收盘价为2bp。

Credit Agricole’s net earnings were disappointing, mainly due to exceptional items. Loan metrics remained robust. Revenues were flat but French retail banking and trading activities performed well. Rising costs were offset by lower provisions and write-backs in its major clients division.

法国农业信贷银行的净收益令人失望,主要原因是特殊项目。 贷款指标仍然强劲。 收入持平,但法国零售银行和交易活动表现良好。 成本上升被主要客户部门的拨备减少和回拨所抵消。

Thomas Cook issued a profit warning and now does not expect to meet its targets. Losses worsened to £1.46bn in the first half of the 2018/19 financial year, partly due to goodwill depreciation in the UK. Dia’s bonds fell after first-quarter sales and EBITDA fell by 7.2% and 78% on lower sales and restructuring costs. Talks to save the company were not making much progress according to Spanish press reports. Santander was reportedly opposed to LetterOne’s terms and would like bond holders to take their share of losses. Europcar Mobility Group (B1/BB-) saw first-quarter sales fall 0.6% while EBITDA slipped to minus €30m vs. minus €21m the previous year, mainly due to Easter falling in April this year. Full-year objectives were nevertheless maintained with sales expected to top €3bn. Vallourec managed to cut losses by half thanks to a sharp rise in sales.

托马斯库克发布盈利预警,现在不期望达到目标。 2018/19财政年度上半年的亏损恶化至14.6亿英镑,部分原因是英国的商誉贬值。 Dia的债券在第一季度销售后下跌,EBITDA因销售和重组成本下降而下跌7.2%和78%。 根据西班牙媒体的报道,挽救公司的谈判没有取得多大进展。 据报道 桑坦德银行反对LetterOne的条款,并希望债券持有人承担损失。 Europcar Mobility Group(B1 / BB-)第一季度销售额下降0.6%,而EBITDA下滑至-3000万欧元,而去年同期为负2100万欧元,主要原因是复活节今年4月下降。 尽管如此,仍保持全年目标,预计销售额将达到30亿欧元。 由于销量大幅上升,Vallourec设法将亏损减少了一半。

Teva, the global N° 1 in generic drugs, came under pressure after 44 US states accused it of colluding with another group on price fixing. Moody’s cut Picard from B2/Stable to B3/Stable citing competitive pressure in France that could delay the group’s debt reduction programme.

Teva是仿制药的全球第1号,在44个美国国家指责它与其他集团在价格垄断方面勾结后受到压力。 穆迪将皮卡德从B2 /稳定下调至B3 /稳定,理由是法国的竞争压力可能推迟该集团的债务减免计划。

M&A rumours swirled in financials over the week. Following the end of talks between Deutsche Bank and Commerzbank, there were press reports that talks between Deutsche Bank and UBS on merging their asset management affiliate had also stalled. UniCredit and ING are reportedly interested in Commerzbank, but there are as yet no official talks. Liberbank and Unicaja ended their merger talks..

本周金融业并购的谣言汹涌澎湃。 在德意志银行与德国商业银行谈判结束后,有媒体报道德意志银行与瑞银集团合并其资产管理子公司的谈判也陷入僵局。 据报道,UniCredit和ING对德国商业银行感兴趣,但目前还没有官方谈判。 Liberbank和Unicaja结束了他们的合并谈判。

In new issues, Sampo (insurance) raised €500m with a 30 year non-call 10 at Tier 2 bond 3.375%. The issue saw strong demand and the bond performed well on the secondary market.

在新发行中,Sampo(保险公司)筹集了5亿欧元,其中30年非拨打10级,第2级债券为3.375%。 该问题的需求强劲,债券在二级市场表现良好。

CONVERTIBLES

可转债市场

The European convertibles market was reasonably active this week with three deals.

欧洲可转债市场本周相当活跃,有三笔交易。

Retirement Homes Group ORPEA raised €500m with 8-year convertibles at 0.375% and a 47.5% premium with the proceeds going on general corporate purposes. Communication solution company GN Store issued €330m with a 2024 bond + warrant structure to finance the repurchase of its outstanding bond + warrant structure due 2022. And JP Morgan raised €400m with a cash-settled exchangeable bond into Siemens due 2022. The bond has a 10% premium and was issued at 107.5% (corresponding to a -2.38% yield to maturity).

退休之家集团ORPEA筹集5亿欧元,8年期可转换债券为0.375%,溢价为47.5%,所得款项用于一般企业用途。 通信解决方案公司GN Store发行了3.2亿欧元,拥有2024债券+认股权证结构,以资助回购其2022年到期的未偿还债券+认股权证结构。 摩根大通于2022年向 西门子募集了4亿欧元的现金结算可交换债券。债券已经 保证金为10%,发行价为107.5%(相当于到期收益率为-2.38%)。

Elsewhere, SONY announced a share buyback programme for up to JPY 200bn and the stock jumped by 10% on Friday. It also announced an agreement with Microsoft on the joint development of cloud solutions for game and content-streaming services. Video game studio Ubisoft reported disappointing fourth-quarter bookings amid a shortfall in “The Division 2” console unit sales (negatively impacted by fierce competition from Apex Legends among others). More announcements should be made at E3 next month. Cloud based application provider New Relic saw strong 28% rise in fourth quarter billing, but its margin outlook was lower than expected due to higher investment in new products.

在其他方面,索尼宣布股票回购计划高达2000亿日元,该股周五上涨10%。 它还宣布与 微软达成协议,共同开发用于游戏和内容流服务的云解决方案。 视频游戏工作室Ubisoft报告第四季度预订令人失望,因为“第2分部”控制台销售不足(受到Apex Legends等激烈竞争的负面影响)。 下个月应在E3发布更多公告。 基于云的应用程序提供商 New Relic第四季度计费增长28%,但由于新产品投资增加,其利润率前景低于预期。